- NXP Benefits

Flexible Spending Accounts

NXP offers 3 different flexible spending account options: Health Care FSA, Limited Use FSA and Dependent Care FSA.

Health Care FSA deadlines

You have until December 31 to incur expenses for the current year.

You have until March 31 to submit expenses from the previous year.

Plan Ahead

At the end of the year or grace period, you lose any money left in your FSA. Don't put more money in your FSA than you think you'll spend within a year on things like copayments, coinsurance, drugs, and other allowed health care costs.

Automatic Claims Adjudication

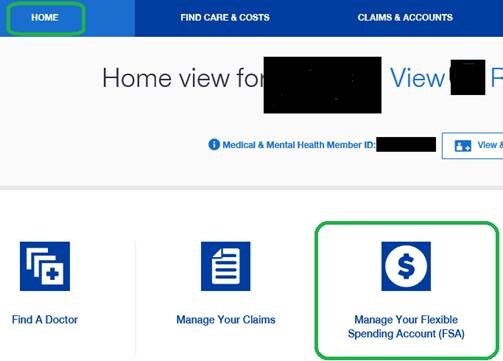

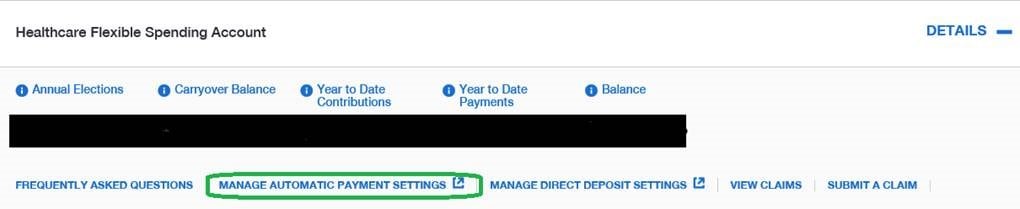

For Medical Flexible Spending Account enrollees only – you can turn on auto claims processing through your flexible spending account for your medical claims only (you will still need to use your debit card for any pharmacy, dental and vision expenses). To turn on coordinated payment for the FSA, please log in to your account at UnitedHealthCare and simply click on Manage Your Flexible Spending Account (FSA), then Management Automatic Payment Settings.

Step 1

Step 2

Step 3

Health Care Flexible Spending Account (FSA)

If you elect to participate in the Health Care FSA, you can contribute up to $3200 in pre-tax income for eligible expense reimbursements.

- Any money contributed must be used for expenses incurred in the same calendar year in accordance with IRS guidelines.

- Beginning Jan. 1, 2025, the Health Care FSA funds will no longer roll over from year to year. You must use your funds by Dec. 31, 2024, or any remaining funds will be forfeited. You have until March 31, 2025, to reimburse yourself for any eligible expenses incurred in 2024.

- Visit irs.gov for a complete list of covered expenses. Refer to Publication 502, Health Care Expenses.

- You will receive a debit card in the mail from Optum Bank® to pay for eligible medical, pharmacy, dental and vision expenses.

- For your convenience, you can also choose to turn on the auto-reimbursement feature for medical expenses only in order to have eligible medical expenses auto submitted for payment from your Health Care FSA.

- You can view your account balance from myuhc.com or the UnitedHealthcare app.

Limited Use Health Care Flexible Spending Account (LFSA)

The Limited Use Health Care FSA is available if you are enrolled in Medical Plan 1. Participating in a Limited Use Health Care FSA helps you maximize the amount you can save pre-tax for dental and vision expenses. You can contribute up to $3,200 in pre-tax contributions for eligible dental and vision expenses. There are limits on the expenses you may submit to your Limited Use Health Care FSA. Enroll and maximize your tax advantage if:

- You’re expecting to incur significant dental and/or vision expenses.

- You don’t want to use your HSA for dental and vision care expenses.

Similar to the Health Care FSA, beginning Jan. 1, 2025, the Health Care FSA funds will no longer roll over from year to year. You must use your funds by Dec. 31, 2024, or any remaining funds will be forfeited. You have until March 31, 2025, to reimburse yourself for any eligible expenses incurred in 2024.

Limited Use Flexible Spending Account Eligibility

The Limited Use FSA is available if you are enrolled in Medical Plan 1. You can contribute to the Limited Flexible Spending Account and Health Savings Account (HSA) at the same time.

Participating in a Limited Use FSA helps you maximize the amount you can save pretax for dental and vision expenses. Enroll and maximize your tax advantage if:

- You’re expecting to incur significant dental and/or vision expenses.

- You don’t want to use your HSA for dental and vision care expenses.

Learn more about how the Limited Use Flexible Spending Account and Health Savings Account work together to bring you optimal tax savings benefits here [English].

Dependent Care Flexible Spending Account

A Dependent Care FSA lets you use pre-tax dollars to pay for eligible expenses related to care for your child, disabled spouse, elderly parent or other dependent who is physically or mentally incapable of self-care, so you can work or your spouse (if you’re married) can work, look for work or attend school full time. As a Dependent Care FSA participant, you can contribute up to $5,000 in pre-tax contributions for qualified dependent care expense reimbursements. Employees earning over $130,000 annually can contribute up to $2,500.

Any money contributed to this account must be used for expenses incurred in the same calendar year or the money is forfeited.

You can change your Dependent Care FSA election amount during annual enrollment or within 30 days of a qualifying life event.

Eligible Dependent Care FSA expenses include:

- A qualified child or elder care center.

- A babysitter or nanny.

- After-school care Registration fees.

- Nursery school tuition.

- A relative who provides care.

- Visit IRS Publication 503 for a complete list of eligible covered dependent care expenses.

Comparison of the different types of FSAs

Click here to see a comparison or see the chart below.

| Plan | Covered Expenses | Maximum Contribution | How claims are paid |

|---|---|---|---|

| Health Care Flexible spending Account (FSA) | Medical, pharmacy, dental and vision care expenses not reimbursed by another Plan | $3,200** | Full annual contribution is available on your first day of participation |

| Limited Use Flexible spending Account (FSA) | Dental and vision care expenses not reimbursed by another Plan | $3,200** | Full annual contribution is available on your first day of participation |

| Dependent Care Flexible Spending Account (DCFSA) | Employment-related dependent care expenses not claims for the federal dependent care income tax credit | $5,000 per calendar year*** | Only amounts already contributed are available |